It’s January and some of your clients in new Medicare Advantage plans give you call. They’re concerned about their plans.

Changing health plans can feel uncertain as they transition from the known to the unknown. What happens when someone makes the move to try out a Medicare Advantage plan for the first time, or switches health plans, and then feels like their new coverage is not the right fit?

Luckily for them, they’re not stuck with their new coverage. Almost immediately after the Annual Enrollment Period (AEP), beneficiaries in Medicare Advantage plans have an option to reconsider their plan selection.

Listen to this article:

Here’s what you need to know about the Medicare Advantage Open Enrollment Period (MA OEP) and the important do’s and don’ts that will keep you compliant.

Medicare Advantage OEP Qualifications

According to the Centers for Medicare & Medicaid Services (CMS), the Open Enrollment Period that most accurately applies to your clients hoping to switch plans after AEP is the MA OEP, if they qualify.

The MA OEP is specifically for:

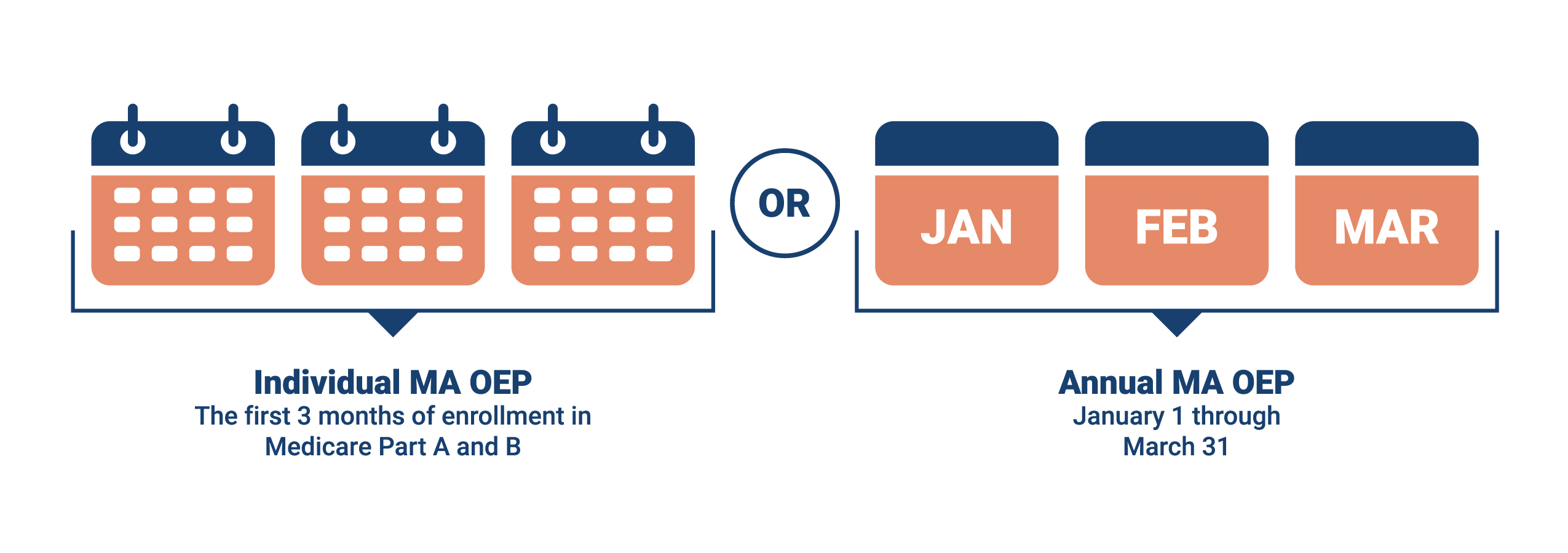

- Clients new to Medicare who enrolled in an MA plan during their Initial Coverage Election Period (ICEP). These beneficiaries have a three-month individualized OEP that starts with the month they are entitled to Part A and B. For example, if your client’s Part A and B eligibility begins June 1, then they have June, July, and August to make certain changes (explained below).

- Those who enrolled in MA plans as of January 1. For these clients, there is an OEP from January 1 to March 31.

This means that your clients calling you in January who are unhappy with their new plan can make a one-time switch in coverage. What can they switch to? They have some options.

MA OEP Enrollment Cans & Can’ts

Here are the key enrollment guidelines to keep in mind:

Remember the MA OEP was created for those with MA plans already. This means that your clients in Original Medicare or Med Supps can’t use OEP as an opportunity to enroll in an MA plan.

Part D changes are also limited and depend on changes to the MA plan. Clients can change their drug coverage by switching from one MAPD plan to another, by changing from an MA only to an MAPD plan, or by returning to Original Medicare and picking up a stand-alone Part D plan. Those with Original Medicare and a Part D plan cannot switch to another drug plan during MA OEP. They’ll have to wait for an SEP or the next AEP.

Marketing Do’s & Don’ts During MA OEP

A big difference for agents between the AEP and the MA OEP is the restriction on marketing.

Agents cannot knowingly target or send unsolicited marketing materials to MA or Part D enrollees during the MA OEP (January 1 to March 31). It’s important to note that “knowingly” takes into account the intended recipient as well as the content of the message.

Note: If a beneficiary who has already made an enrollment decision unintentionally receives marketing information, it’s not considered “knowingly targeted.”

Here are some examples of things you should not communicate to your clients concerning OEP.

- Don’t like your new Medicare Plan? Reach out to me about your disenrollment options.

- Did you know you can switch your MA plan from now until March 31? Let’s make an appointment.

Effective Date of Coverage and Beyond

Coverage on a plan chosen during the MA OEP begins the first day of the month following the month an MA company gets the enrollment request. For example, if a client enrolls in a different MA plan on March 3, their new plan’s effective date would be April 1.

But note that the company in question can decide whether or not they’re open to enrollments during MA OEP, which means your clients are not guaranteed a plan during this period. Make sure you know which of the carriers you represent allows enrollments during MA OEP before making recommendations.

That doesn’t mean your clients are stuck if this is the case. They may be eligible for multiple enrollment periods occurring within this one. For instance, they may qualify for an SEP, so it’s possible their request for coverage will be accepted but under a different coverage start date.

Something to Think About

Before the MA OEP begins in January, reach out to your clients to make sure they understand their plans and that they are happy with them. Let them know you’re available if they have any questions or need further assistance. By doing so, you’ll provide your clients with a feeling of security, and as a result, they’ll be far more likely to refer their family and friends to you.

Remember, if you’re not contacting your clients throughout the year, another agent may seize the opportunity to gain their trust. A client who has questions or is confused with their plan is far more susceptible to allowing another agent write them into an MA plan next time around. Protect your business; don’t let the hard work you put into AEP go to waste.

Questions about compliance requirements during the MA OEP? Reach out to us at [email protected].

Editor’s Note: This article has been updated to include the most relevant information.

Share Post