As an insurance agent, you’re constantly evaluating the needs of your clients to find the best-fitting plan. Did you know that completing health risk assessments can streamline this process and increase your earnings?

Health risk assessments are an excellent tool for determining gaps in your clients’ care and coverage, but why do carriers, physicians, and the Centers for Medicare & Medicaid Services (CMS) want you to fill them out? What makes them worth your time and effort?

What Is a Health Risk Assessment?

A health risk assessment (HRA), also called a health appraisal or health assessment, is a screening tool used to gather beneficiary health information and includes a questionnaire, assessment of health status, and personalized feedback. They aren’t just a Medicare thing. Employers and carriers for different types of insurance use HRAs as a screening tool to collect and evaluate the health statuses of individuals.

During an HRA, a beneficiary discloses information about:

- Health status

- Demographics

- Health risk factors, including physical, psychosocial, and behavioral risks

- Social determinants of health

- Functions of daily living

The results of an HRA demonstrate a beneficiary’s health risks, gaps in care, and the impact of factors such as socioeconomic status, location, lifestyle choices, and more. The data gathered helps health professionals and insurers determine where beneficiaries experience health needs and how best to fill those gaps with personalized, patient-centered care. Think of them as running diagnostics.

Coordinated Care: HRAs & Medicare Advantage

In 2012, CMS ruled that physicians must complete HRAs during annual wellness visits for patients with Medicare Part B. That benefit extends to those who opt for Part C; however, CMS encourages but doesn’t require (except in certain circumstances) that beneficiaries complete an HRA at the time of enrollment in a Medicare Advantage (MA) plan.

MA follows a coordination of care model, a value-based approach that encourages all components of an individual’s care team to work together and provide the most holistic care possible. These components may include primary care providers, insurance companies, personal caregivers, specialists, therapists, and more. Coordination of care relies on effective communication facilitated by such processes as completing HRAs.

Coordination of care relies on effective communication facilitated by such processes as completing HRAs.

For MA carriers, the HRA information can be collected in person by a qualified health professional or through a survey during the enrollment process. Most of the carriers that we work with at Ritter Insurance Marketing have adopted the survey-based model and include an HRA as part of the MA enrollment process.

CMS recommends carriers conduct HRAs annually so that providers can give their best coordinated and continuous care. Not all carriers conduct HRAs; however, if carriers offer Special Needs Plans (SNPs) — D-SNPs, C-SNPs, and I-SNPs — they must perform HRAs on all new applicants during the time of enrollment and then annually thereafter. New regulations will standardize the HRA process for SNPs in the coming years.

The Benefits of Completing HRAs for Agents & Clients

If utilized well, HRAs can be a big boon to both you and your clients. Survey-based HRAs (if offered by the MA carrier) are one tool you can use to better communicate and strengthen the relationship between you, your clients, and their health care providers.

Benefits for Your Clients

We’ve already alluded to the main benefits of HRAs for MA enrollees. According to the Better Medicare Alliance, the end goals of HRAs are to:

- Identify health status, needs, and critical gaps in care

- Ensure beneficiaries receive personalized, patient-centered care at the right time

- Help providers provide appropriate clinical treatment

- Help providers better understand the overall population

- Guide providers in delivering more targeted care to community as a whole

As you can see, HRAs can grow from helping the individual to helping the community at large. Health care providers rely on HRAs to provide a fuller picture of someone’s health status — more than they’d be able to ascertain from just a yearly physical exam. In exchange, the patient receives more complete care.

HRAs can grow from helping the individual to helping the community at large.

Benefits for You

Besides the knowledge that you’re improving the health care system when you fill out HRAs for your clients, here are some other benefits for agents like you:

- Strengthen dialogue and trust between you and your client

- Learn more about what your client needs

- Potentially receive payment from carriers for submitting

As your clients’ trusted advisor, you’re a key player in their coordination of care. When you submit survey-based HRAs on behalf of your client, everyone can benefit.

As your clients’ trusted advisor, you’re a key player in their coordination of care.

Submitting Health Risk Assessments

Each insurance company offering MA plans treats HRAs a little differently. Some don’t conduct them at all. Some allow you to submit HRAs through paper forms, while others only allow online submission through an agent portal. Some place strict time limits on when you can submit, and yet, others limit which plans pay for completing an HRA.

All the different approaches can be overwhelming. That’s why we’re working on a solution for you!

Ritter’s Built-in HRA Solution

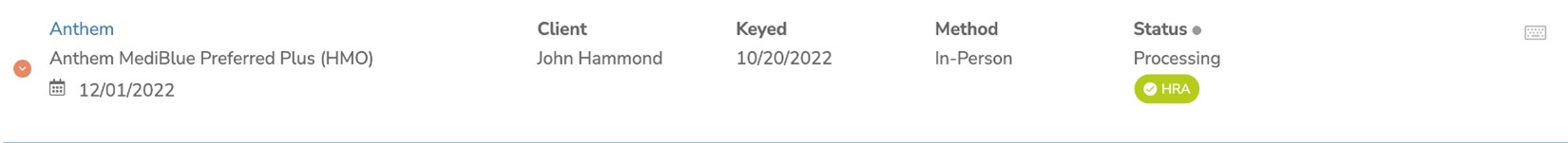

We’ve launched a built-in feature in our agent Platform that makes submitting an HRA for your client easy and streamlined. For now, we’ve only launched this feature with one carrier, Anthem, but we have plans to expand this offering to other carriers soon!

To submit an HRA for Anthem, navigate to the Submissions page on the Platform and complete the assessment within seven days of an enrollment being submitted by clicking on the red button that appears in the Status column. Once completed, the status will change to a green check mark.

For more information on submitting HRAs for Anthem, check out our Ritter Docs page on Submissions

Start submitting HRAs today with Ritter! Register to gain free access.

Access HRA Instructions

Until we’ve expanded the built-in feature to more carriers, we’ve been busy compiling HRA instructions for different MA carriers to facilitate the process for you. Head over to our Docs page to view instructions on how to submit HRAs, which plan enrollments will receive a payment, and where to go for submissions.

While we strive hard to keep this page updated with accurate information, we cannot guarantee its information is complete or fully accurate. Reaching out directly to your contracted carriers is still the best way to ensure proper HRA submission. If you have any questions about the information we provide, please email [email protected].

Your participation in the coordination of your client’s care matters! HRAs are a great tool for identifying need and fostering holistic care and improved public health. With each HRA you complete, you better our health care system. We all need agents like you!

Register with Ritter to stay up to date on all our tools and resources, including HRA instructions, the Ritter Platform, CallVault, Shop & Enroll, and more!

Share Post