Craig Ritter, CEO of Ritter Insurance Marketing, recently gave his annual address to hundreds of agents from across the country both in-person and via webinar.

This year, we offered a live and in-person State of the Senior market address and expo just outside of Philadelphia, PA! We had a great turnout and overall experience. We look to keep enhancing this Ritter staple all our agents know and enjoy!

Below, we’re covering the highlights of a year of significant prosperity for Ritter and Medicare in many ways as we recap the State of the Senior Market for 2023.

Reviewing Ritter’s 2022

May 2022 brought an exciting new partnership with Integrity! We’re continually grateful to be affiliated with the leading distributor of life and health insurance in America. This partnership enables us to support you and your business is greater ways through increased products, services, and expertise.

By the Numbers

Medicare Advantage production for 2022 increased 15 percent, totaling 100,008 enrollments! With Medicare Supplements, Ritter saw a seven percent decrease in premium production, totaling $34,721,857, throughout the full plan year. Finally, Medicare Part D, we also saw a decrease of 15 percent in enrollments from last year for a total of 59,356 enrollments.

Our 2023 AEP saw some ups and downs. Our total number of AEP-specific MA enrollments was up 11 percent from the 2022 AEP, bringing in 45,852. In contrast, our Part D enrollments were down 50 percent from the previous AEP, for a total of 23,752. Our grand total of enrollments for the 2023 AEP was 69,604. That is definitely a number to be proud of!

Medicare Advantage production for 2022 increased 15 percent, totaling 100,008 enrollments!

Additionally, we added four new Medicare contracts, bringing our total number of MA and PDP parent companies to 50!

Technology Advancements

The Ritter Platform received exciting enhancements while efforts were made to make Ritter’s login process more secure with multi-factor authentication (MFA).

Introducing CallVault

In response to the call recording requirement from the Centers for Medicare & Medicaid Services (CMS), our in-house software development team produced CallVault as solution. From within the Ritter Platform, CallVault equips our agents to easily and seamlessly record and store both outbound and inbound calls, including plan presentations. We’re proud that we were able to readily produce a tool for our agents to use during the 2023 AEP to make adhering to the call recording mandate a little easier.

Check out these brief videos to see inbound and outbound calls with CallVault in action!

Inbound

Outbound

The CallVault compliant call recording feature is available today to all agents registered with RitterIM.com.

Bringing Multi-Factor Authentication to Ritter Logins

We also added MFA to Ritter account logins. The safety and privacy of both our agents and their clients are of the utmost importance to us. By adding MFA as another layer of protection to our Ritter accounts, we’re making data even more secure against possible digital threats.

Adding Health Risk Assessments

New for 2022, we added the ability to complete a health risk assessment (HRA) on the Submissions tab of the Platform for select Anthem BlueCross and BlueShield plans! Currently, we’re working to add HRAs to Shop & Enroll so our agents can earn more by helping their clients complete this additional enrollment benefit.

Plan Year 2022 Medicare Enrollment Stats

When reviewing statistics for Medicare enrollment, one thing is abundantly clear — MA growth isn’t slowing down anytime soon!

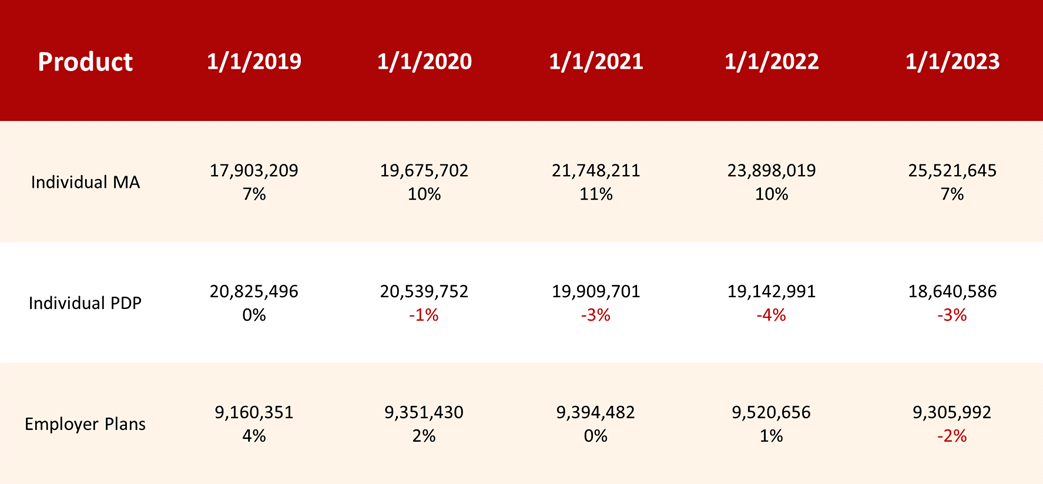

Growth by Plan Type

Individual MA enrollments were up seven percent as of January 1, 2023! UnitedHealthcare once again emerged as the MA market leader, with more than seven million enrollees at of the beginning of February 2023. UnitedHealthcare was trailed by Humana, in second place, and CVS/Aetna, in third. Elevance (Anthem) also saw notable growth in MA enrollments, with a 5.1 percent positive year-over-year change.

Special Needs Plan enrollments grew by an impressive 20 percent!

Special needs plans (SNPs) and local PPO plans had the most significant bump in enrollments, with SNPs growing by an impressive 20 percent and local PPOs growing by 14.4 percent.

Looking at PDPs, enrollment has declined by about three percent. This could reflect the increased enrollment in MA plans that already come with Part D coverage and negate the need for a stand-alone plan. For the PDP market, CVS Health (Aetna) had the largest number of enrollments with 4,795,227, while Clear Spring Health had the largest percent of increase year-over-year with 50.3 percent! The majority of the other PDP parent companies saw a decrease in enrollments, with the exception of Wellcare and Cigna.

Growth by State

For the third consecutive year, Texas had the highest number of enrollments — 74,900. Florida and Pennsylvania followed with 61,525 and 43,043 enrollments respectively.

In the recording of the address, we dive deeper into carrier growth per state, so check that out if you want additional localized insight!

Medicare Regulation, Legislation, and Industry Trend Updates

The 2022 plan year led to some trends that are mostly positive and expected, as well as some advancements by CMS to continue clarifying how to market and sell Medicare plans in a compliant manner.

Changes in Revenue

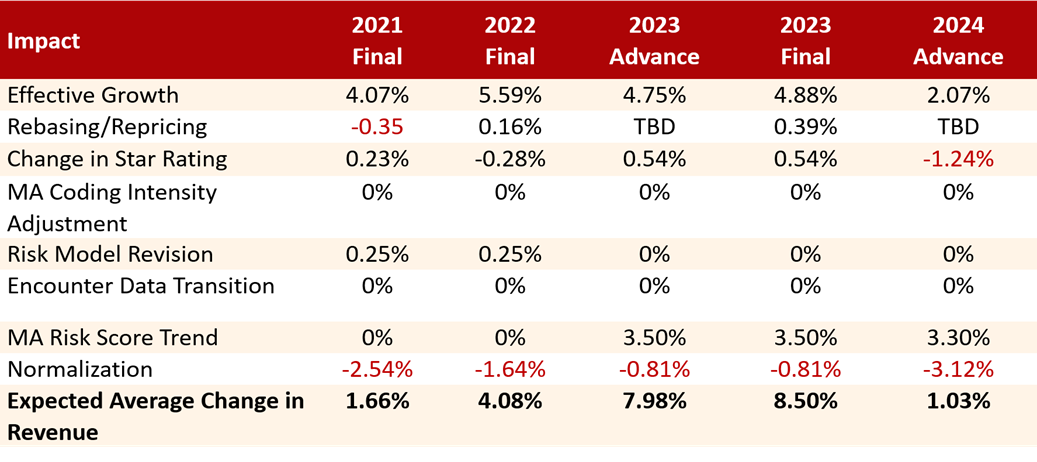

In 2022, the maximum broker commissions for MA and Part D agents grew, with a nationwide average increase of 4.88 percent for MAPD renewals, and a 4.55 percent increase for PDP renewals. While the figures for 2024 won’t be released until around the end of May, we expect to see further increase in MA broker commissions!

2024 Advance Notice

CMS estimated a 3.12 percent decrease in normalization. Changes from IDC-9 to IDC-10 will, on balance, eliminate about 2,000 current Risk Codes from being eligible for an increase in payment (2,294 eliminated and 264 added). Payer’s analysis indicated payment reduction will be greater, specifically in the dually eligible population.

Also, CMS expects to see a 1.24 percent drop in Medicare Advantage star ratings in 2024. Payer’s analysis indicated the payment reduction will be greater.

The CMS versus Payer analysis, which was funded by the Better Medicare Alliance, reveals a 3.30 percent difference, though CMS disputes this analysis. The combination of the two factors above lead to Payer’s estimated 2.27 percent payment reduction versus the 1.03 percent increase that CMS estimated.

Proposed Final Rule from CMS

The proposed Final Rule from CMS comes with major broker implications including:

- Use of a Benefit Change Pre-Enrollment Checklist

- Six-month expiration on Permission to Contact

- Limits on TPMO-to-TPMO lead transfers

- Reduction in call recording requirements

- Reinstating restrictions on educational events

- Reinstating the 48-hour rule for Scopes of Appointment

- Changes to the TPMO disclaimer

- Limits on use of the Medicare name, logo, and card

We expect to receive the Final Rule around late April or early May. At that point, we’ll know which, if not all, of these proposals will go into effect for the 2024 Plan Year.

Inflation Reduction Act

In August of 2022, President Biden signed the Inflation Reduction Act (IRA) of 2022 into law. This is set to bring about changes to Medicare Part D. For 2023, we will see a $35 max copay for insulin, $0 copay for adult vaccinations, and a cap on manufacturer drug price increases. Next year, 2024, will be impacted by the removal of five percent coinsurance for the catastrophic phase and a low-income subsidy expansion. Additionally, a $2,000 out-of-pocket cap is set to be put in place for Part D in 2025.

For 2023, the IRA will bring a $35 max copay for insulin, $0 copay for adult vaccinations, and a cap on manufacturer drug price increases.

As for long-term effects, from 2024 to 2030, there will be a six percent premium cap on Part D costs, and Medicare is expected to negotiate drug prices starting 2026 to 2029.

For a closer look at these new requirements and Ritter’s recommended marketing guidelines, please watch the recording of the State of the Senior Market address.

The future of Medicare sales looks bright! We’re excited to see what other advancements happen in the next year as we expand our business and can’t wait to continue leading agents to success!

If you were unable to attend this year’s State of the Senior Market address, you can watch the recording here whenever you’d like! If you aren’t yet a Ritter agent, register with us today to start selling smarter than ever with an excellent partner by your side.

Share Post