Craig Ritter, CEO of Ritter Insurance Marketing, recently gave his annual address to hundreds of agents from across the country in a live webinar.

We’ll discuss the highlights of a year of significant growth for Ritter and Medicare in many ways as we recap the State of the Senior Market for 2022!

Reviewing Ritter’s 2021

In our three core markets of Medicare Advantage (MA), Medicare Supplement, and prescription drug plans (PDPs), Ritter saw impressive growth. This not only reflected the easing of pandemic-related restrictions that affected the two most recent plan years and Annual Enrollment Periods (AEPs), but also the growth and dedication of our agents and agencies.

By the Numbers

Starting with Medicare Supplements, Ritter saw a two percent increase in premium production, totaling $37,346,126, throughout the full plan year. For Medicare Part D, we saw a 15 percent increase in enrollments from last year for a total of 69,793 enrollments. Finally, we saw the largest growth in our MA enrollments which were at 86,963 — up 20 percent in 2021!

We saw the largest growth in our MA enrollments, which were up 20 percent in 2021!

We’re equally proud of the growth exemplified by our AEP-specific enrollment numbers! Our agency saw MA enrollments increase 26 percent from the prior AEP, to a total of 41,658 enrollments within those seven and a half weeks. There was a 13 percent increase in our agents’ Part D sales for a total of 47,736 enrollments.

Additionally, we added 13 new Medicare contracts, about the largest annual increase in MA contracts we’ve ever had! This brings our total number of MA and PDP parent companies to 49! Over 2022, we’re expanding our presence in the Affordable Care Act (ACA) marketplace so our agents can sell to more clients under the age of 65 in select markets.

Expanding Our Reach

Ritter worked diligently in 2021 to expand our physical presence throughout the country. We continued the efforts we began last year by acquiring even more businesses who proudly represent our brand.

These new partnerships include:

- Executive Resource Insurance Network (ERIN) — Increased our presence in Florida and added one new Medicare FMO relationship

- Delaware Valley Brokerage Services — Allowed us to provide more local, personalized support to agents in Philadelphia and the surrounding areas for both Medicare and ACA contracts

- Hargrove Financial — Increased our presence in Washington and added two new Medicare FMO relationships

More broadly, we’ve increased our number of employees nationwide to around 270 full-time workers, which is an increase of 40 people since 2021.

Technology Advancements

Not only did our signature Shop & Enroll program reach new peaks this year, but our Platform CRM and Medicare Quote Engine received some awesome upgrades as well!

Easing Enrollment

During 2021, nine new carriers partnered with us for Shop & Enroll. Our current roster of available carriers on Shop & Enroll consists of five PDP and 32 MA carriers — the most we’ve ever had available since the website’s inception! We also implemented our new FastTrack enrollment process, which expedites the application process for both agent and client alike.

The graph below shows the year-over-year growth in the number of Shop & Enroll enrollments collected. We’ve continued to see stellar growth through this past year as online enrollments continue to become available for more carriers!

Our current roster of available carriers on Shop & Enroll consists five PDP and 32 MA carriers — the most we’ve ever had available since the website’s inception!

Improving Our CRM

Our Platform CRM gained even more agency management capabilities, allowing uplines to assign leads and clients to their downlines! The ability to perform such tasks in one centralized location like the Platform was a highly anticipated improvement requested by our own agents — and we’re proud to deliver! Furthermore, we added the ability to quote multiple pharmacies in our quote engine as well as a Provider Lookup tool. This improved technology within our own tools makes it easier than ever for our agents to keep selling smoothly!

Plan Year 2021 Medicare Enrollment Stats

When reviewing statistics for Medicare enrollment, one thing is abundantly clear — MA growth isn’t slowing down anytime soon!

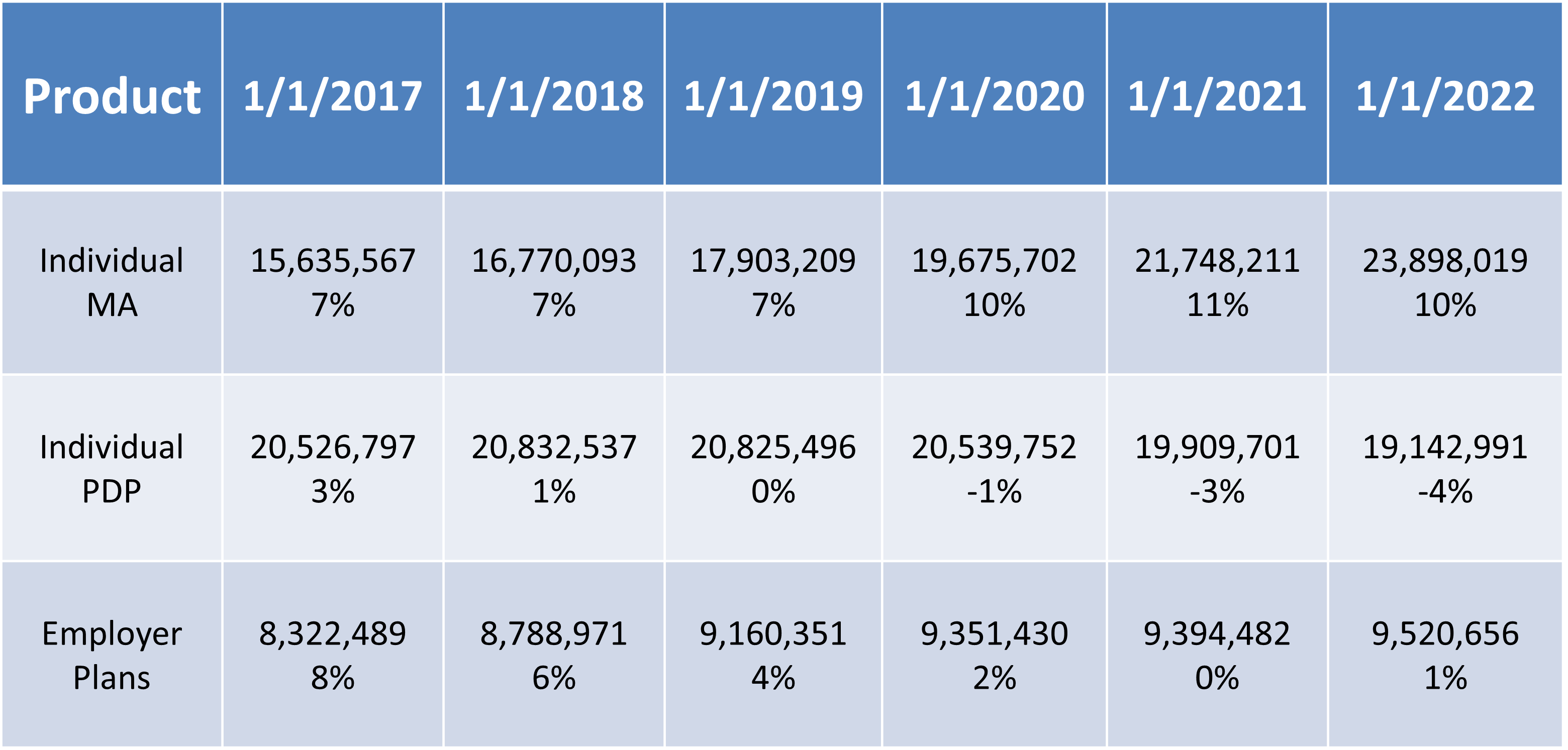

Growth by Plan Type

Individual MA enrollments are up 10 percent as of January 1, 2022, making it the third year in a row of double-digit growth! This equates to a little over two million more enrollments than during the previous plan year. UnitedHealthcare once again emerged as the MA market leader, with more than 6.1 million enrollees as of the beginning of 2022. UnitedHealthcare was trailed by Humana, in second place, and CVS/Aetna, in third. Anthem and Centene (Wellcare) also saw notable growth in MA enrollments, with 28.9 percent and 32.5 percent positive year-over-year changes, respectively, between 2021 and 2022.

On the flip side, PDP enrollment has declined by about 4 percent. This could reflect the increased enrollment in MA plans that already come with Part D coverage and negate the need for a stand-alone plan. For the PDP market, we see CVS Health (Aetna) with the largest enrollment and largest growth in the past year, at 6.7 percent, where all other PDP parent companies saw a decrease in enrollments.

Individual MA enrollments are up 10 percent as of January 1, 2022, making it the third year in a row of double-digit growth!

Local PPO plans and Special Needs Plans had the most significant bump in enrollments, with local PPOs growing by 21 percent and Special Needs Plans growing by 19.9 percent.

Growth by State

For the second consecutive year, Texas had the highest number of Medicare Advantage enrollments — 67,943 beneficiaries. Florida and California followed with 51,955 and 47,217 enrollments respectively. UnitedHealthcare leads the pack in terms of market share per state. Other stand-out carriers like Aetna, Anthem, and Centene (Wellcare) are market leaders in several states throughout the country.

In the recording of the address, we dive deeper into carrier growth per state, so check that out if you want additional localized insight!

Medicare Legislation and Trend Updates

The 2021 plan year led to some trends that are mostly positive and expected, as well as some advancements by CMS to continue clarifying how to most effectively market and sell Medicare plans in a compliant manner.

Changes in Revenue

The expected average change in revenue from the already released 2023 Advanced Notice was up 4.08 percent in 2022 and could rise to 7.98 percent in 2023. The notice also proposed changes to improve health equity and to advance health and social needs for Medicare beneficiaries. These changes could include gathering better and more individualistic data about beneficiaries and developing quality measures and methodological enhancements to close the health disparity gap and utilize the Medicare program more efficiently.

In 2021, the maximum broker commissions for MA and Part D agents grew, with a nationwide average increase of 6.3 percent for MAPD renewals, and a 7.32 percent increase for PDP renewals. While the figures for 2023 won’t be released until around the end of May, we expect to see a 3.7 percent to 7.7 percent increase in MA broker commissions.

2022 Broker Commissions v. 2021 Broker Commissions

| Initial | Renewal | |||||

| Product | Region | 2021 | 2022 | % | 2021 | 2022 | % |

| MAPD | National | $539 | $573 | 6.31% | $270 | $287 | 6.30% |

CT, PA, DC | $607 | $646 | 6.43% | $304 | $323 | 6.25% | |

CA, NJ | $672 | $715 | 6.40% | $336 | $358 | 6.55% | |

Puerto Rico, U.S. Virgin Islands | $370 | $394 | 6.49% | $185 | $197 | 6.49% | |

| PDP | National | $81 | $87 | 7.41% | $41 | $44 | 7.32% |

While the figures for 2023 won’t be released until around the end of May, we expect to see a 3.7 percent to 7.7 percent increase in MA broker commissions.

Reforming Third-Party Medicare Marketing

You may remember seeing ads last year promoting plans which were only available in limited-service areas or to a small group of people, but were being broadcast nationally, causing confusion. This caused CMS to release a memo to MA companies expressing their concerns over misleading marketing and marketing tactics, in turn causing most carriers to tighten their marketing guidelines and increase FMO oversight.

CMS may require sales calls to be recorded, but as of now, those specific requirements are uncertain. Ritter is working closely with our carrier partners to clarify what types of calls that requirement specifically applies to, such as all sales calls or only telesales/call enter operations.

For a closer look at these new requirements and Ritter’s recommended marketing guidelines, please watch the recording of the State of the Senior Market address.

Medicare Trends and Growth Rates

As we hope to see continue, the growth in the MA market has been mostly positive! MA plans are growing at a 9 percent to 10 percent rate and should continue to grow as the market becomes more competitive and MA plans continue to be more inclusive in their offerings. For commission rates, we’ve seen a 5 percent to 6 percent growth rate for MA commissions, and a 6 percent to 7 percent growth rate for PDP commissions — very exciting figures for agents! Medicare Supplement commission rates have stayed flat as a percentage.

In terms of non-numerical growth, we’ve seen MA plans becoming more abundant with their offerings and improving their benefit design and complexity to become even more appealing for the Medicare population! As the market becomes more competitive, it may become more difficult to compare plans to each other, but it’s helping to increase the quality of care that beneficiaries will receive. Medicare Supplement rates are increasing 4 percent to 6 percent, but that’s less than what was initially predicted.

The future of Medicare sales looks bright, with enrollment and commissions poised to continue their rapid growth. We’re excited to see what other advancements happen in the next year as we expand our business and can’t wait to continue leading agents to success!

If you were unable to attend this year’s State of the Senior Market address, you can watch the recording here whenever you’d like! If you aren’t yet a Ritter agent, register with us today to start selling smarter than ever with an excellent partner by your side.

Share Post