Craig Ritter, CEO of Ritter Insurance Marketing, once again gave his annual State of the Senior Market address, but this year, with a little twist.

Rather than one long webinar, his address was broken into a four-part video series with each episode covering one of the four usual topics: The Year in Review at Ritter, Medicare Regulation and Legislation, Enrollment Stats for 2019 and Major Industry Trends.

Below we have provided the highlights but if you want the full rundown, make sure you watch the full episodes!

Visit the State of the Senior Market homepage

The Year in Review at Ritter

The past year was one full of success and expansion for Ritter! During the full year of 2019, Ritter agents increased Medicare Advantage (MA) enrollments by 17 percent from 2018 with a total of 63,177 enrollments. While Medicare Supplement and prescription drug plan (PDP) enrollments were down five and 16 percent respectively in 2019, as a whole for all product enrollments in 2019, there was an 8.56 percent increase from 2018.

Ritter also established new Medicare carrier relationships with Health First, Optima, and Oscar. We had no terminations of MA plans in 2019 and we’re already working on two new opportunities with health plans for 2021.

Ritter’s staff increased by 30 employees to make a grand total of 220 full-time employees for 2019. Not to mention we made a huge increase in space by consolidating our three Harrisburg offices into one last April. Now all of our employees at Ritter Headquarters are all under the same roof in our wonderful, three-story office!

Ritter Tech & Resources

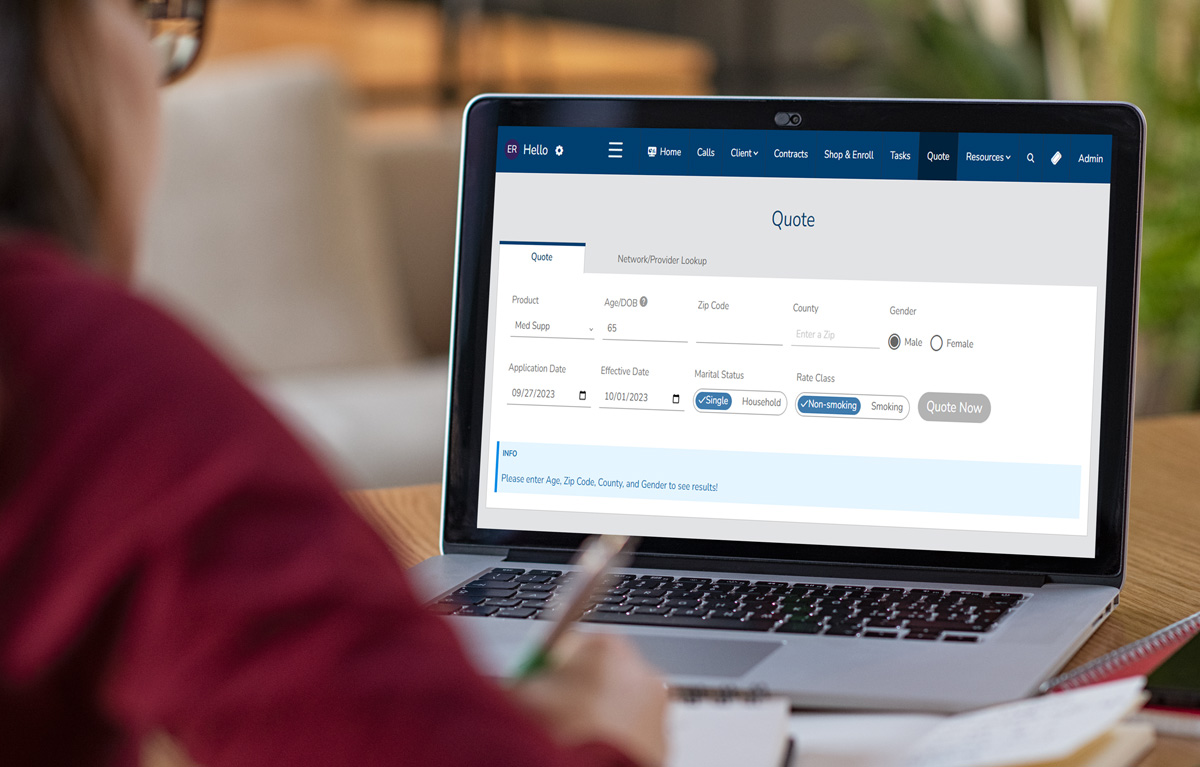

Meet Shop & Enroll — For the 2024 AEP, we rebranded Medicareful to Shop & Enroll. It’s the same great tool, with the same great features, just a new look and feel. Learn about the rebrand

Along with the increase in enrollments and employees in 2019, our resources also saw substantial growth! Medicareful, our CMS-approved quoting and enrollment tool reached a 90 percent increase in the number of agents with their own Medicareful page. Also, we had an impressive 80 percent increase in the number of agents submitting applications through Medicareful. In addition, an astounding 22,570 enrollments were submitted through Medicareful last AEP!

A consumer account feature was also added to Medicareful in 2019. Now, clients have the ability to provide info such as, preferred physicians, prescription drugs, and pharmacy information and more — all in one easily accessible location. In quarter four of last year, when we first launched this new feature, data from more than 15,000 clients was added into this new consumer account feature!

A big change within Ritter tech for 2019 was the launch of our new, comprehensive agent dashboard – the Ritter Platform. The Platform replaced the various tools off of RitterIM.com and has integrated all of our applications such as the Medicare Quote Engine, submissions, contracts, commissions, carrier info, and more into one interface.

We have big plans for 2020 that include more enrollment opportunities, partnerships and new plan options, a prescription drug price estimator on the Ritter Platform and a revamped contracting application!

Medicare Regulation and Legislation

Regulation

A minor change within MACRA is elimination of first-dollar coverage for newly eligible beneficiaries. These changes went into effect on January 1 of this year. MACRA defines newly eligible beneficiaries as anyone reaching 65, or first becomes eligible for Medicare benefits due to disability, or End Stage Renal Disease (ESRD) on or after January 1, 2020. So, as of the beginning of this year, the newly eligible cannot be enrolled in Medicare Supplement Plans C, F, or high-deductible F. A high-deductible Plan G is available for these beneficiaries to enroll in.

Also, CMS proposed a change that starting January 1, 2021, individuals with kidney failure or ESRD will be able to enroll in Medicare Advantage plans. The Centers for Medicare and Medicaid Services (CMS) is pushing for some cost reduction programs, and at the top of the list is home dialysis, which is less costly and actually more effective in treating kidney failure.

Additionally, CMS is proposing changes to the MA plan star ratings, increasing flexibility in providing non-primary health related supplemental benefits, expanding the definition of chronic illness, and expanding access to MA plans in rural communities.

Legislation

Regarding Medicare legislation, the COBRA fix bill proposes to make COBRA coverage creditable for Medicare Part B. The passing of this legislation can remedy issues that arise for Medicare beneficiaries, who elect COBRA coverage prior to enrolling into Part B.

HR 1682 is another current legislation that regards observation stays. Part A of Original Medicare requires a three-day hospital stay prior to receiving a skilled nursing facility benefit. Currently, CMS does not count observation as a part of the three-day hospital stay. So, this bill proposes that observation stays satisfy a part of the three-day hospital stay in order for beneficiaries to receive coverage for the skilled nursing facility benefit.

Enrollment Stats for 2019

In 2019 there was double-digit growth in the individual MA market. Almost 20 million Medicare beneficiaries are enrolled in individual MA plans. The individual PDP market has had almost no change throughout the past four years and there has been slow growth seen among the employer plans.

Ritter contracts with 14 of the top 25 MA plans in terms of their total enrollment! The top four carriers, UnitedHealthcare, Humana, CVS Health, and Anthem, represent almost six in 10 MA beneficiaries. From January 1, 2019, to January 1, 2020, traditional MA HMO plans have seen a rise in the annual growth rate of 9.1 percent. MA local PPO has risen more than double the benchmark with 21.7 percent growth and meanwhile, MA regional PPO is on the decline from 2019 with a 12.1 percent reduction.

We suggest you definitely tune into this episode so you can see these figures more for yourself while Craig provides you with further details and insight.

Major Industry Trends

There have been steady rates in the last couple years with the annual Part B deductible, though this year it increased more dramatically. The 2020 Medicare Part B deductible is $198, a $13 increase from 2019. These increases impact Plan F premiums, and as most of you may already know, due to MACRA, Plan C and F are no longer available to Medicare beneficiaries who first qualify for Parts A and B after January 1, 2020. For those still eligible to enroll in Plan F, we expect they may see lower premium pricing.

Some other interesting Medicare Supplement trends include:

- Higher discounts for household benefits for couples who purchase their Medicare Supplement policies together

- Movement toward instant underwriting decisions

- Enrollment for telephonic sales, due to carriers now allowing the collection of a client’s signature by the answer of a “secret question”

Most new business in the PDP market has been plan changes, which means little growth has been seen in the market. The top six PDP carriers control 92% of the market, which is down two percent from the previous year. Something to come is a sixth tier being added for Preferred Specialty Pharmacy drugs.

Thank you to all of our dedicated agents for your hard work and success. If you aren’t a Ritter agent, it is never too late to partner with us! Register with Ritter for free today. We are looking forward to a very successful 2020!

Share Post